First we will cover what is a “lease option to purchase,” next we will explain who a lease option purchase is good for and finally where you can find some of these homes in your area or in a area you wish to find. So below we will list 3 the most user friendly easiest or simplest  way for dummies, no pun intended so you can truthfully have a better outlook on the whole program before stepping foot out there looking for a home.

way for dummies, no pun intended so you can truthfully have a better outlook on the whole program before stepping foot out there looking for a home.

1. What’s a lease option to purchase?

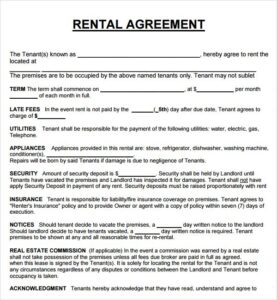

This lease option to purchase is pretty much self explanatory, however there may be some unanswered questions so I will cover a couple features. The most important is the ability to purchase a home after the renting the home once the lease agreement is finished, however It does not guarantee you the ability to buy the home however you are first in line after the lease is finished or in some instances before the lease is done. The option to purchase obviously will depend on your ability to obtain the money through your own bank account or perhaps applying for a mortgage loan. If you know that you may have some credit issues a 2 or 3 year lease option to purchase the home may be best fit for you as sometimes it takes longer than normal for your credit to be repaired after some collections defaults or bankruptcies. So please bare in mind of some of these elements before signing any lease agreements.

2. Who is a lease option good for?

As mentioned above its great for people who are not quite ready to purchase the home as their is either some income or credit issues that they will like to improve before they fully commit to buying a home. Purchasing a home is a huge investment most likely the largest of your life so take things slowly and do your research as you want to make sure you get this right even if you need to improve your credit score by 20 points to get the interest rate that can save you $500 or more on your monthly payment. So this lease option is great for these options. Another reason which we just stumbled upon is some homes in your are are just not for sale yet. Some of these sellers are not willing to sell their homes at the current market rate and would rather wait 2 or 3 years when the market condition improve before the commit to selling their investment.

3. How do you find a rent to own home?

Their are many websites to choose from however we have stumbled across one that is not a credit repair website LOL. Yes be careful most of these sites may have good intentions to help you regarding your financial situation however you may already know how to fix your credit and is just looking for some homes. So we highly suggest renttoownassistance.org to begin this search s they have a 7 day trial that you can test out before using their full membership. Yes we do know of some great credit repair companies however we found that its best to give a user what they want instead of trying to sell them on something they don’t want. Other Articles